ORIGINATION

Trinity has the strongest roster of correspondent lenders in Texas, including some of the most sophisticated sources of debt in the market. These lenders routinely invest billions of dollars in commercial mortgages annually. They offer a full range of loan structures, including floating and fixed rate debt, higher leverage mezzanine loans, bridge loans, and even some equity investments. We are also able to provide construction/permanent loans or forward commitments out to a full year.

In addition to our correspondents, Trinity also has the ability to access various Fannie Mae and Freddie Mac sources, as well as the most competitive and well managed CMBS (securitized) lenders in the market. We also have strong relationships with REITs, pension fund advisors, banks, private equity funds and non-correspondent lenders.

Our lenders offer non-recourse loans, provide flexible prepayments, and typically lend money at par. Trinity’s loan size is $1 million and up, and we have financed properties in excess of $100 million. We have the resources to finance office buildings, anchored and unanchored retail centers, regional malls, apartments, hotels, credit leased properties, industrial warehouses and service centers, self-storage facilities, mobile home parks and country clubs.

SERVICING

Trinity has a strong commitment to servicing the loans we originate. This commitment grows out of a conviction that both borrower and lender are best served by our continuing relationship. We consider it “service after the sale” and it is an integral part of our business philosophy and we believe contributes to the growth of the business.

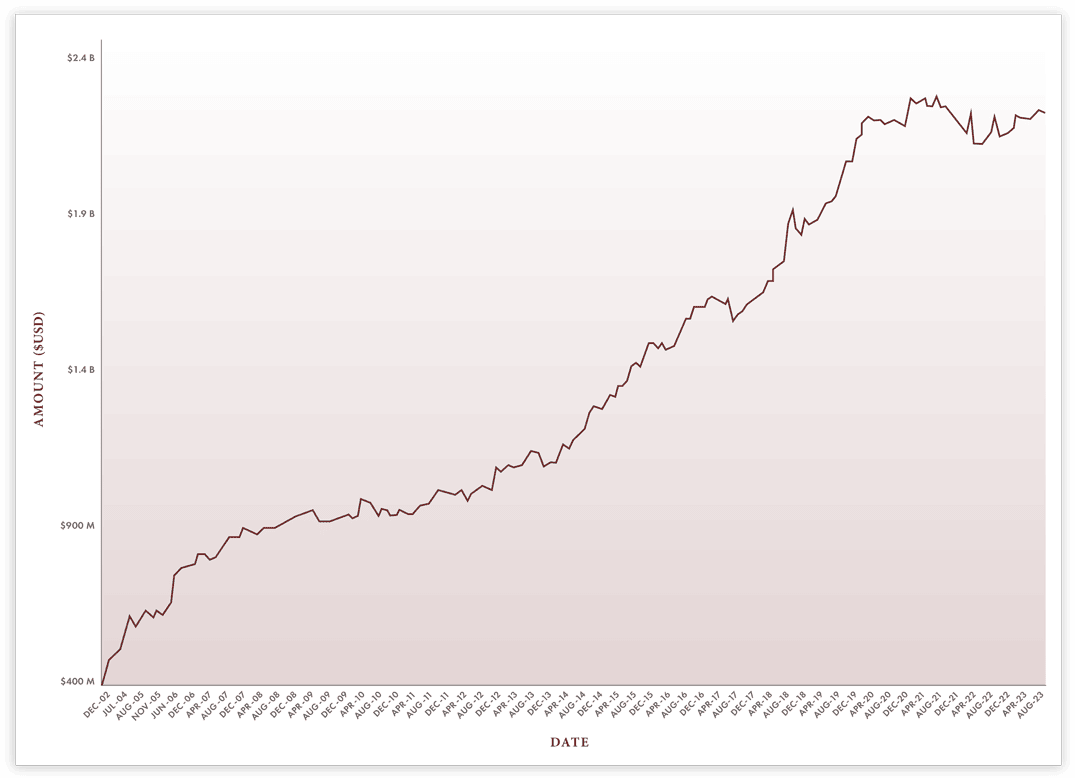

Trinity began servicing loans in June of 1996 with five servicing correspondents, a $96,000,000 portfolio and a servicing staff of one. Today the portfolio exceeds $2.2 billion and includes 32 correspondent relationships and five servicing professionals.